- View all solutions

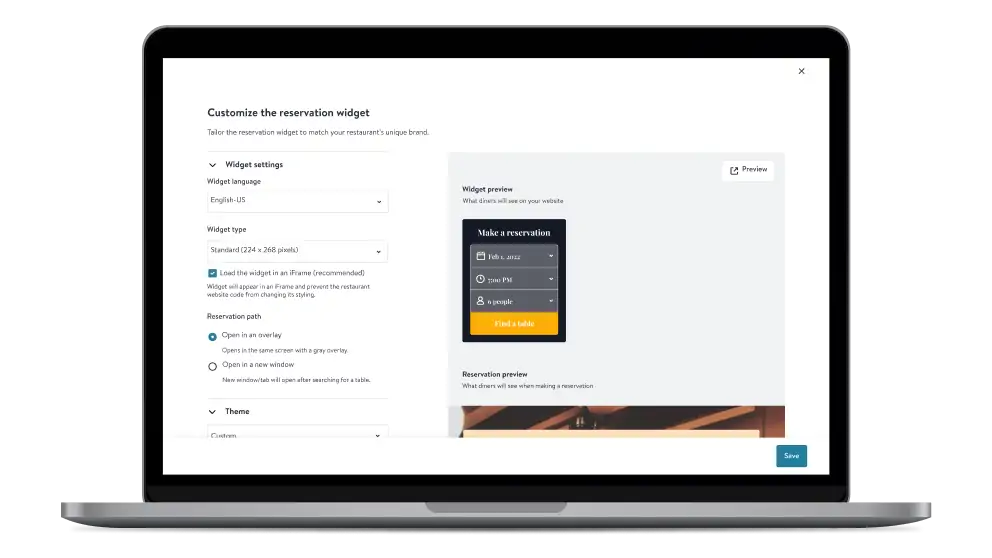

- Restaurant reservation software

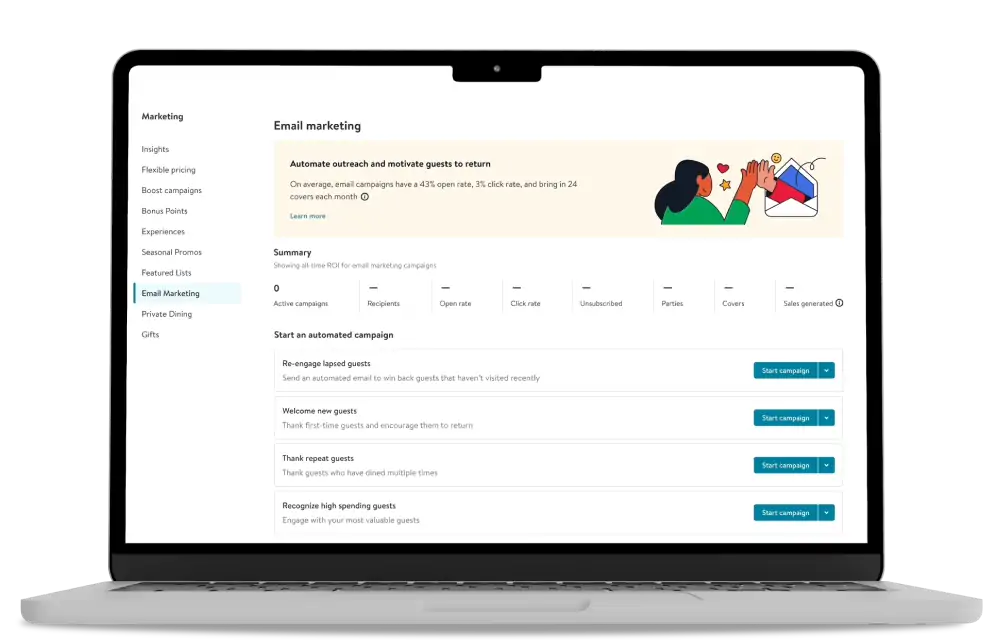

- Digital marketing solutions

- Restaurant table management

- Online ordering for restaurants

- Experiences

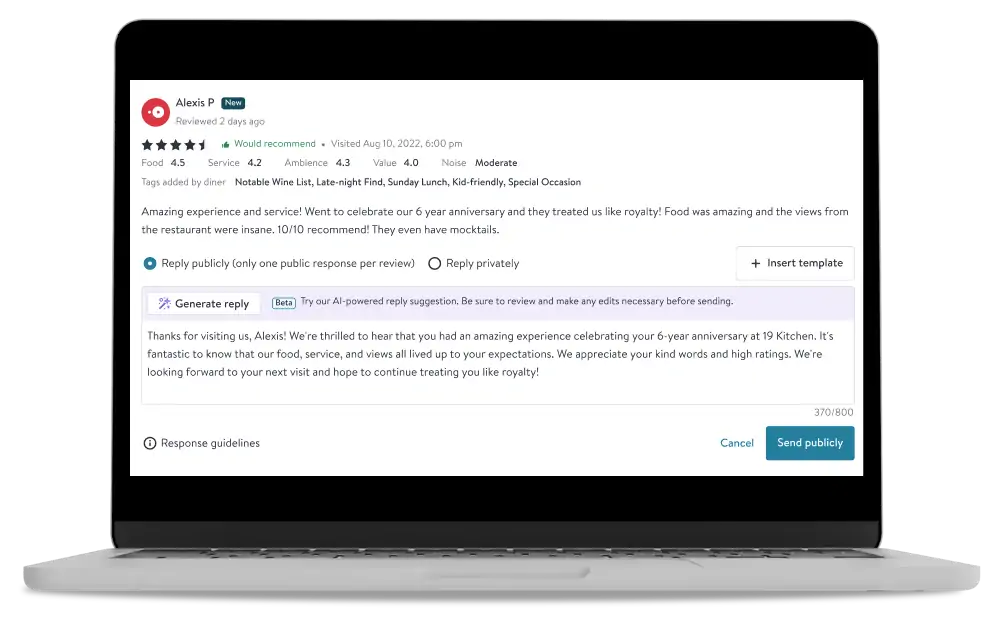

- Reputation and reviews

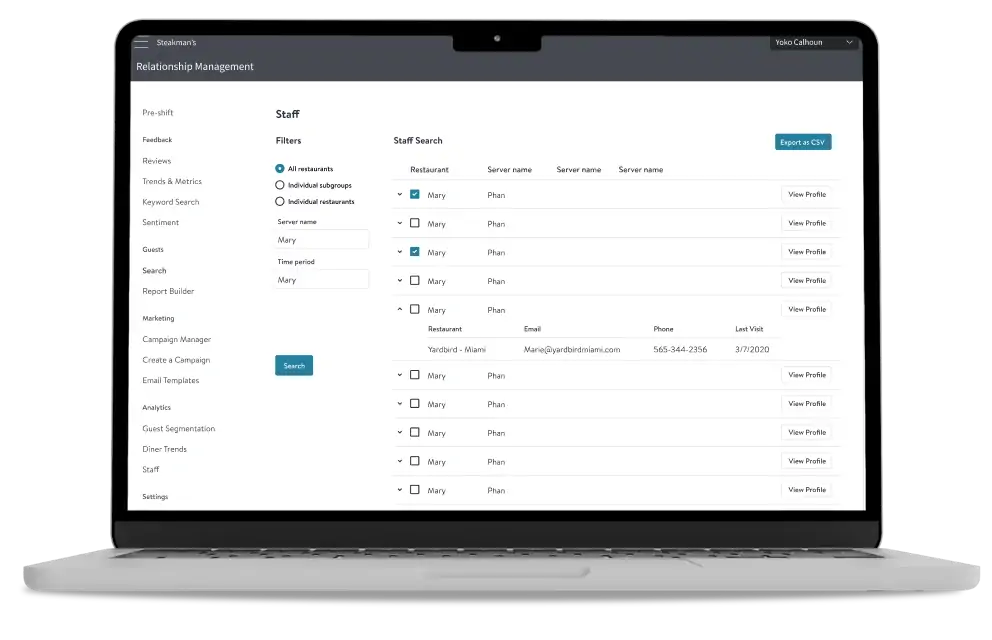

- Relationship management

- OpenTable integrations

- For restaurants

- For restaurant groups

- For bars and wineries

- For hotels and casinos

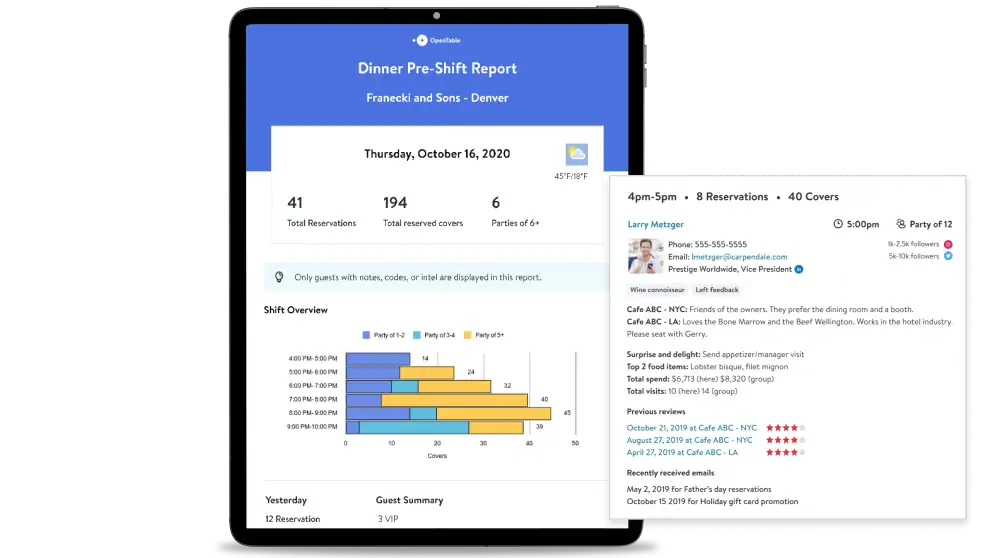

- Robust reporting and insights

- The largest diner network

- The best customer service

- Pricing

- View all solutions

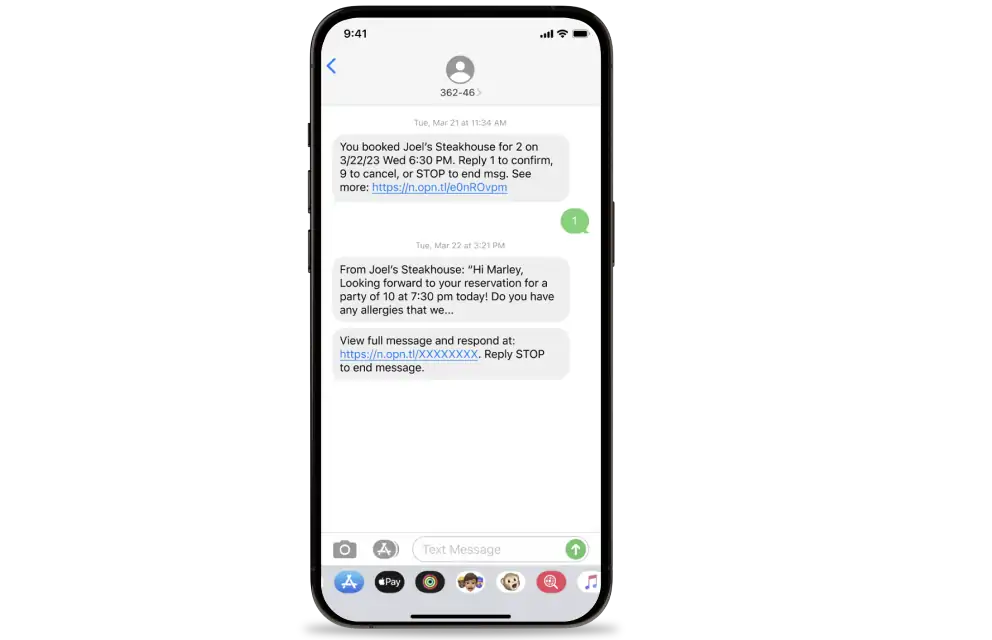

- Restaurant reservation software

- Digital marketing solutions

- Restaurant table management

- Online ordering for restaurants

- Experiences

- Reputation and reviews

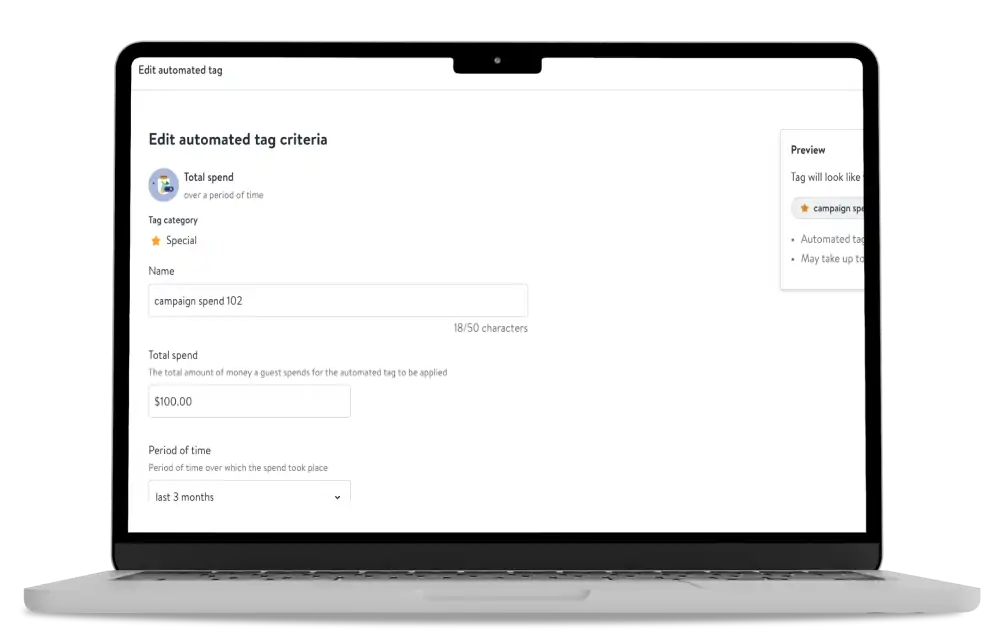

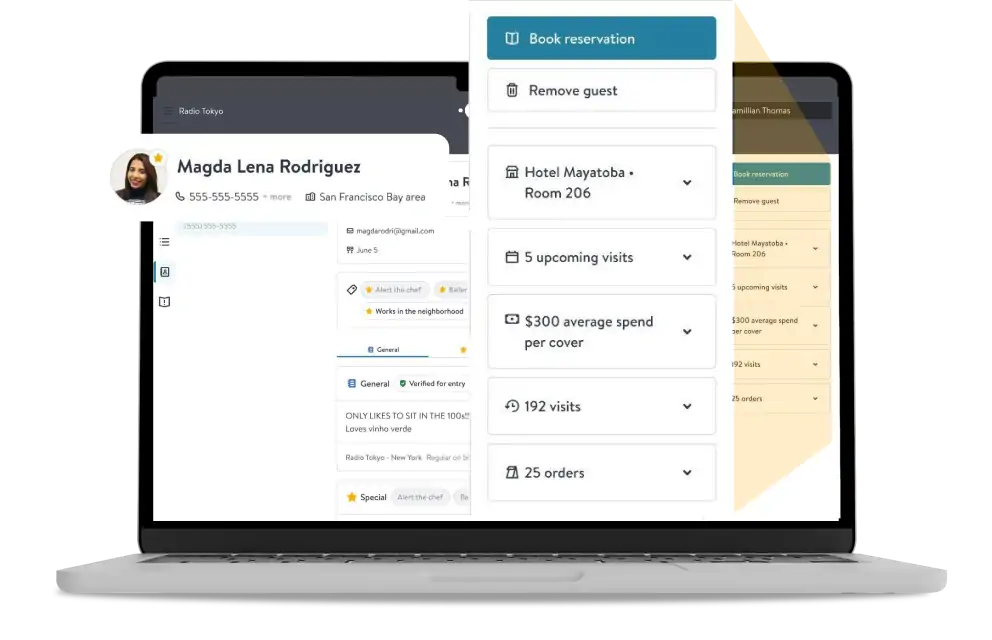

- Relationship management

- OpenTable integrations

Your comprehensive, central restaurant management platform

Access the world’s largest dining network to attract diners and see how OpenTable can also help you manage your reputation, streamline your operations, and drive repeat visits.

Find the right solution for your restaurant

Our plans are based on your management needs:

- Basic (entry-level): access OpenTable’s global diner network and manage your restaurant’s reputation all in one place

- Core (robust): Basic features, with the added ability to maximize your seatings, automate table statusing, and more

- Pro (comprehensive): all Basic and Core features, plus relationship management to help create regulars with targeted marketing

SolutionsWhy OpenTableMoreGET OPENTABLE

Need help deciding which option is best for you? Give us a call at

Join us onCopyright © 2024 OpenTable, Inc. 1 Montgomery St Ste 500, San Francisco CA 94104 – All rights reserved.OpenTable is part of Booking Holdings Inc., the world leader in online travel & related services.